GOOD WORD

GOOD WORD

- All

- Austin McWilliams

- Ben Kuykendall

- Brady McGill

- Bryan Richardson

- Chelsea Ritter

- Christina Lepp

- Dan Van Nada

- Dan Wilson

- Edward Bean

- Jeré Matheny

- Jesse King

- Market Updates

- Michael Castrilli

- Michaela Brull

- Property Management Tips & Tricks

- Stories of Stewardship

- Tenant Representation

- Trent Scott

- Trey Gravenstein

- What's New with FCPG?

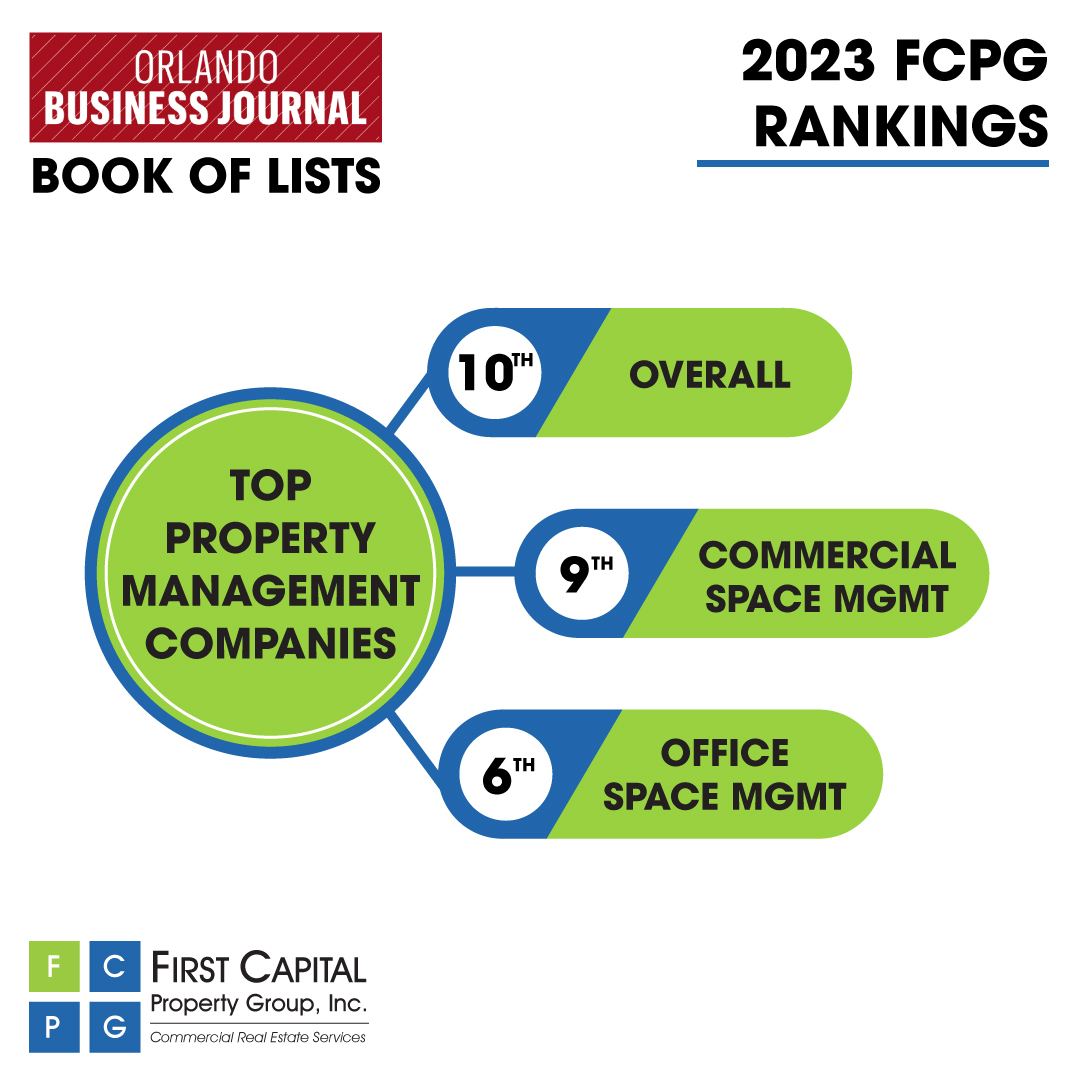

What’s new with FCPG?

Learn about the latest deals, both lease and sales, that the FCPG Brokerage Team has closed, the new accounts that have been acquired by the FCPG Property Management Team, and Testimonials from clients. Internal announcements are also featured in this section of the Good Word blog; this includes promotions, new hires and community events.

What’s the news in the Marketplace?

First Capital Property Group, Inc. provides their insight into the Commercial Real Estate market in Central Florida. The FCPG Brokerage Team reports on the happenings in the markets where they are active with properties. This section of the blog provides a focused stream of Central Florida Commercial Real Estate news, events and other interesting, relevant topics.

Whats good advice or insight applicable to CRE?

With over two decades of experience managing Commercial Property and Brokering Sale and Lease deals comes a unique insight into the Commercial Real Estate market and a wealth of knowledge to be shared. This section of the FCPG Good Word Blog provides a place where FCPG’s Property Management and Brokerage Team alike can share advice and their outlook on the Commercial Real Estate happenings.